Suta and futa tax calculator

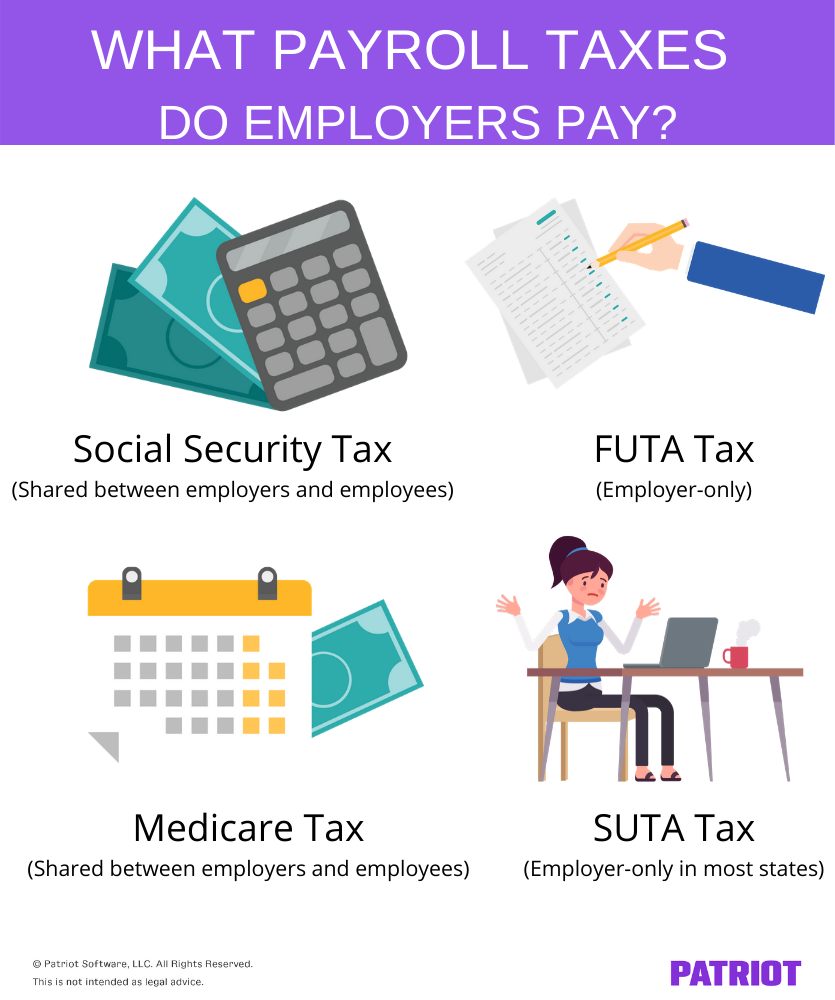

Multiply the total wages paid to your employee by the current employee rate. Regular unemployment insurance UI benefits are paid to eligible people who are unemployed or have had their hours reduced through no fault of their own.

Payroll Tax Rates 2022 Guide Forbes Advisor

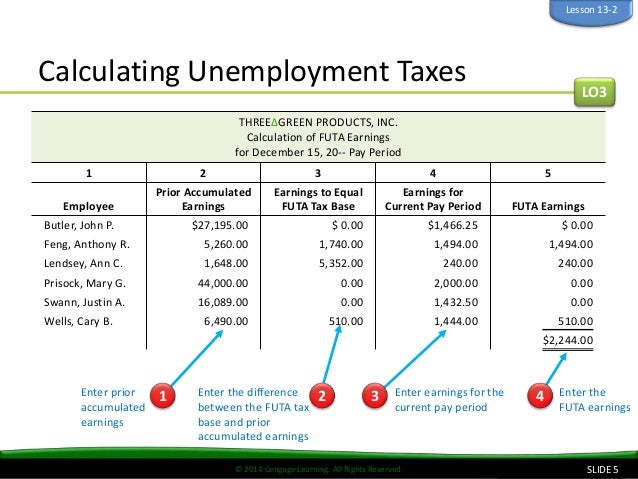

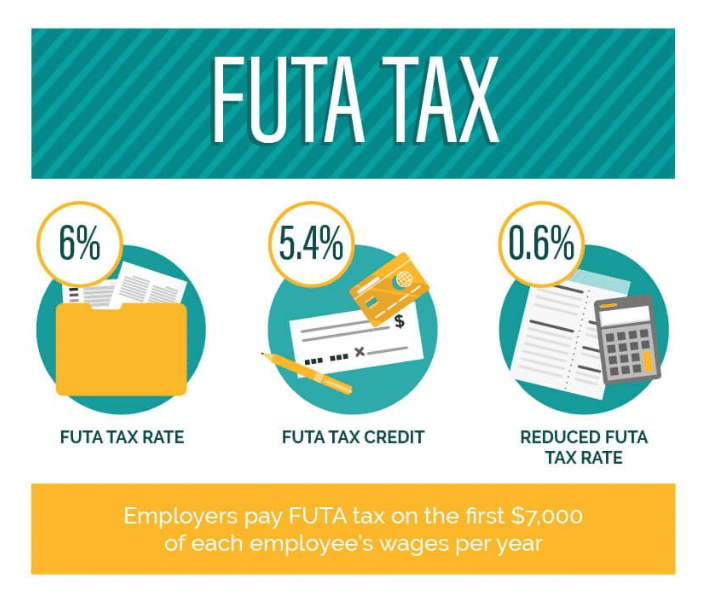

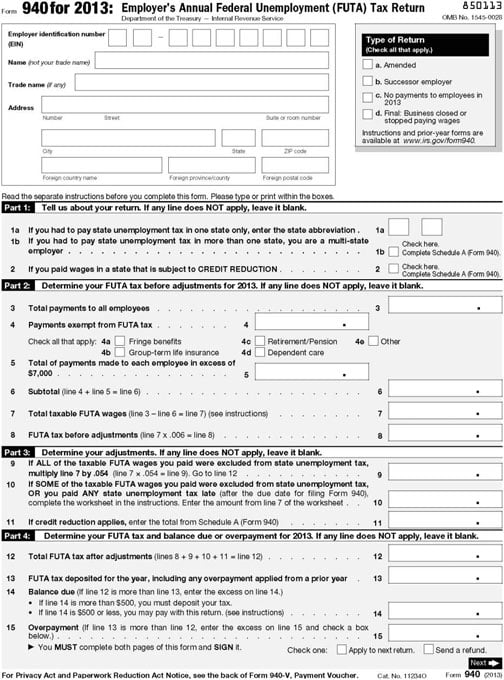

The FUTA tax applies to the first 7000 of.

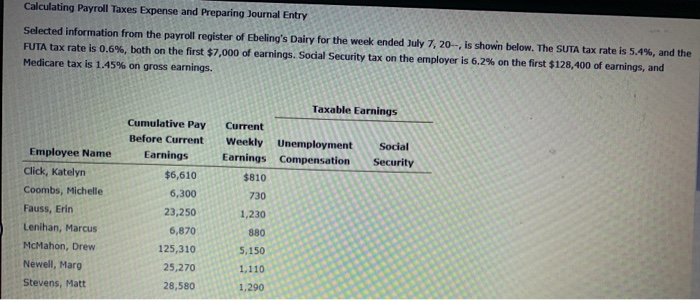

. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Add up the wages paid during the reporting period to your employees who are subject to FUTA tax. Calculate the amount of SUTA tax for the employee.

However it is subject to a reduction of a maximum of 54 from state unemployment. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. For example an employee.

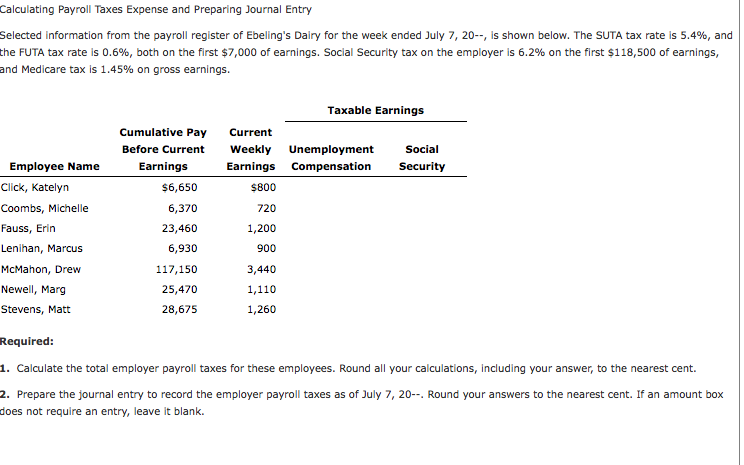

The FUTA tax rate is a flat 6 but is reduced to just. Aug 31 2022 UI Payroll Taxes. An additional 235 Medicare tax 145 base tax plus 9 surtax is levied on wages in excess of 200000 250000 for joint returns.

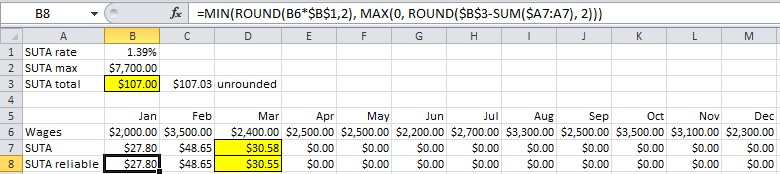

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. How to Calculate FUTA Add up the wages paid during the reporting period to your employees who are subject to FUTA tax. Note that 7700139 is 10703 but the statutory limit is 10700 rounded to the dollar.

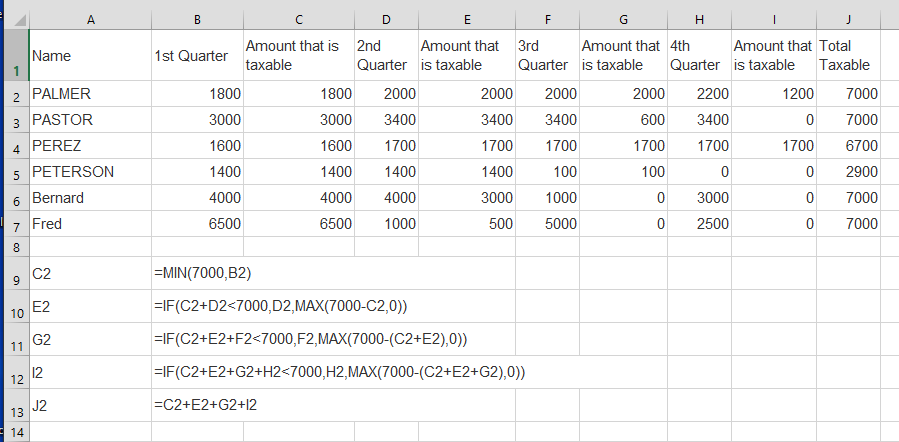

The FUTA and SUTA wages in the Employee Summary table are no longer used. Once an employee reaches the wage base the company is no. Thus the max SUTA in Mar is 3055 not 3058.

Ideally the unemployment tax is. FUTA Tax Rates and Taxable Wage Base Limit for 2022. These period end reports are much more functional because they print multiple states SUTA.

How to Calculate FUTA Tax. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax minus a 54 credit. The states SUTA wage base is 7000 per.

125000 for married taxpayers filing. How To Calculate Payroll Taxes Futa Sui. Your FUTA tax liability after the credit will be 06 of the first 7000 each employee earns.

When calculating FUTA taxes it is important to understand the kinds of incomes that need to be taxed. Web This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment. The federal FUTA is the same for all employers 60 percent.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Calculate the amount of SUTA tax for the employee.

In order to calculate the tax liability you would use the assigned tax rate multiple times the wages paid- up to the wage base. For example if you own a non-construction business in California in. Nov 15 2019 Heres how to figure your SUTA tax.

7000 John 2000 Paul 4000 George. The FUTA tax rate for 2022 is 60 on the first 7000 of wages paid to each employee during the year. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance.

The states SUTA wage base is 7000. Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario. The standard FUTA tax rate is 6 so your max.

For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income. Calculate the Employee Portion. 7000 John 2000 Paul 4000 George.

Of course if you want to allow for. Multiply the percentage of required SUTA tax by the employees gross wages including all tips commissions and. Jun 30 2022 How to Calculate FUTA.

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

What Is The Futa Tax 2022 Tax Rates And Info Onpay

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

Solved Calculating Payroll Taxes Expense And Preparing Chegg Com

The Top How To Calculate Federal Unemployment Tax

Calculating Futa And Suta Youtube

What Are Employer Taxes And Employee Taxes Gusto

What Is Futa Tax It Business Mind

Formulate If Statement To Calculate Futa Wages Microsoft Community

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Unemployment Tax Futa Dummies

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Futa Tax Overview How It Works How To Calculate